Efficient invoicing and billing are vital components of a successful law firm. Timely and accurate billing ensures steady cash flow and fosters positive client relationships. However, manual invoicing processes can be time-consuming and prone to errors, impacting the firm's productivity and profitability. Tom Boster from Legal Management Magazine stated,

"Good timekeeping practices guide your firm's strategy and business decisions by revealing the profitability and efficiencies of specific practice areas."

This is where law firm billing software comes to the rescue. Designed specifically for legal professionals, law firm billing software streamlines the invoicing process, making it faster, more accurate, and less labor-intensive. In this section, we will explore the significance of efficient invoicing and billing for law firms and delve into how law firm billing software can be a game-changer for legal practice.

The Importance of Efficient Invoicing and Billing for Law Firms

Efficiency in invoicing and billing is crucial for several reasons:

Prompt Payments: Timely invoices encourage clients to make timely payments, ensuring steady cash flow for the law firm. Efficient invoicing minimizes delays, improving the firm's financial stability.

Client Satisfaction: Clear and well-organized invoices enhance client satisfaction by providing transparency and accountability in the billing process. Satisfied clients are more likely to refer others and become loyal patrons of the firm.

Time Savings: Manual invoicing can be time-consuming, diverting valuable resources from core legal activities. Efficient invoicing frees up time for attorneys to focus on delivering high-quality legal services.

Compliance and Accuracy: Accurate and compliant billing reduces the risk of disputes and potential legal issues related to billing practices. It ensures that the firm adheres to ethical standards and maintains a positive reputation.

Streamlining the Invoicing Process with Law Firm Billing Software

Law firm billing software revolutionizes the invoicing process by automating repetitive tasks and providing a user-friendly interface. Some key features include:

Automated Time Tracking: The software tracks billable hours automatically, eliminating the need for manual time entries. This ensures accurate billing and minimizes underbilling or overbilling.

Customizable Invoice Templates: Law firm billing software offers customizable invoice templates, allowing firms to add their logo, terms, and specific details. This creates a professional and consistent brand image.

Client and Matter-based Invoicing: The software allows firms to generate invoices based on specific clients or matters, simplifying complex billing scenarios.

Expense Management: Some software solutions integrate expense management, enabling firms to include reimbursable expenses directly in the invoices.

Introducing the Benefits of Using Law Firm Billing Software

By adopting legal billing software, legal professionals can experience a plethora of benefits:

Improved Efficiency:Automating invoicing tasks reduces manual work and simplifies the billing process, saving time and effort.

Faster Payments: With quicker invoicing and prompt delivery, clients are more likely to pay promptly, enhancing cash flow.

Error Reduction: Automated processes reduce the chances of billing errors, improving accuracy and compliance.

Enhanced Client Communication: Clear and detailed invoices build trust and foster better communication with clients.

Data-driven Insights: Often provides reporting and analytics, offering valuable insights into financial performance and billing trends.

Greater Productivity: By freeing up time spent on manual invoicing, attorneys can focus on core legal tasks, enhancing productivity and client service.

In the next sections, we will dive deeper into specific features and benefits of law firm billing software, empowering legal professionals to unlock new levels of efficiency and success in their invoicing practices.

Trust Accounting Made Easy

Understanding Trust Accounting and Its Significance for Law Firms

Trust accounting is a critical aspect of legal practice, particularly for firms that handle client funds, such as retainers or advance payments. Trust accounts must be managed with precision and in compliance with strict ethical and legal regulations. Proper trust accounting ensures that client funds are safeguarded and used only for the intended purposes.

In this section, we will delve into the significance of trust accounting for law firms and the potential complexities involved in managing trust accounts. We will also explore how legal billing software simplifies trust accounting tasks, providing attorneys with the tools they need to maintain accurate and transparent trust accounting records.

How Billing Software Simplifies Trust Accounting Tasks

Legal billing software simplifies trust accounting in several ways:

Automated Trust Transactions: The software automates trust transactions, making it easy to record deposits, withdrawals, and transfers accurately. This minimizes the risk of errors and ensures proper accounting.

Real-time Balances: Attorneys can access real-time trust account balances, allowing them to stay informed about each client's trust funds' status.

Reconciliations: Trust account reconciliations are simplified, saving time and effort, and ensuring that the trust account balance matches the software records.

Compliance Checks: Trust accounting software often includes built-in compliance checks to ensure that transactions adhere to ethical and legal guidelines.

Audit Trail: Maintains an audit trail of trust accounting activities, providing transparency and accountability.

Ensuring Compliance and Accuracy in Trust Accounting with Software Tools

Compliance with trust accounting regulations is paramount for law firms to avoid potential ethical and legal issues. Legal billing software offers features that promote trust account compliance:

Ethical Safeguards: Trust accounting software incorporates built-in ethical safeguards, preventing common trust account violations.

Automated Notifications: The software may include automated notifications for low trust balances or outstanding client obligations.

Transaction Tracking: Attorneys can easily track trust account transactions, ensuring all activities are accurately recorded.

Reporting and Auditing: Legal billing software provides detailed reports and audit trails that facilitate internal and external audits.

Secure Access: Trust accounting software ensures secure access to trust account information, limiting access to authorized personnel.

By utilizing billing software for trust accounting, legal professionals can maintain compliance, reduce administrative burden, and instill confidence in their clients regarding trust fund management.

The Role of Time Tracking in Law Firm Billing and Invoicing

Accurate time tracking is the backbone of efficient billing and invoicing in law firms. As legal services are often billed based on billable hours, precise time tracking ensures that clients are billed correctly for the work performed. Time tracking also provides valuable insights into attorneys' productivity and the allocation of resources. Bill4Time posted an article on The National Law Review and said,

"Law Firms can benefit from systematic time tracking because of the increased efficiency, productivity, transparency, and client trust."

In this section, we will explore the importance of time tracking in law firm billing and invoicing, as well as how it contributes to transparency and fair billing practices. We will also discuss the challenges associated with manual time tracking and how law firm billing software addresses these challenges.

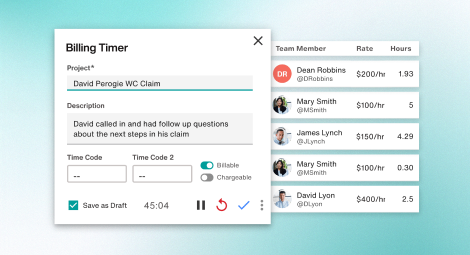

Features and Capabilities of Time Tracker Software for Law Firms

Legal billing software offers a comprehensive range of time tracking features to streamline the process:

Automated Time Capture: Time tracker software can automatically capture billable activities based on work performed, eliminating the need for manual time entries.

Real-time Tracking: Attorneys can track their time in real-time, ensuring that billable hours are accurately recorded as they work.

Matter-based Time Tracking: Time tracking software allows attorneys to allocate time entries to specific matters or cases, facilitating precise billing.

Mobile Time Tracking: Some software solutions offer mobile apps, enabling time tracking on the go, even outside the office.

Integration with Billing: Seamless integration between time tracking and billing simplifies invoice generation, ensuring that billable hours are included in the final invoices.

Enhancing Productivity and Profitability through Efficient Time Management

Efficient time management has a significant impact on law firm productivity and profitability:

Resource Allocation: Time tracking data helps law firms allocate resources effectively, ensuring that cases are staffed appropriately for maximum efficiency.

Productivity Insights: Attorneys can identify productivity patterns and areas for improvement based on time tracking data.

Accurate Billing: Automated time tracking reduces the risk of underbilling or overbilling, resulting in fair and accurate client invoicing.

Transparent Client Communication: Detailed time entries on invoices provide clients with transparency and a clear breakdown of the services provided.

Strategic Decision-Making: Time tracking data offers valuable insights for strategic decision-making and optimizing the firm's operations.

By leveraging billing software for time tracking and management, legal professionals can automate their workflow, improve productivity, and ensure fair and efficient billing practices.

Exploring Time and Billing Software Tailored for Accountants and Law Firms

Time and billing software designed specifically for accountants and law firms offer a wide array of features to simplify billing processes. These specialized software solutions cater to the unique needs of legal professionals and accountants, ensuring accurate and efficient billing practices.

In this section, we will delve into the key features of time and billing software tailored for accountants and law firms. We will explore how these solutions address the challenges faced in billing clients for professional services and modernize the entire billing workflow.

Benefits of Integrated Time and Billing Software Solutions

Integrated time and billing software solutions provide numerous advantages for law firms and accountants:

Seamless Data Integration: Integrated software solutions allow for seamless data exchange between time tracking, billing, and accounting modules, reducing duplicate entries and errors.

Accurate Invoicing: Integrated software solutions ensure that time entries are accurately reflected in client invoices, minimizing billing discrepancies.

Financial Reporting: Integrated time and billing software provides comprehensive financial reports, enabling law firms and accountants to gain insights into their financial performance.

Client Management: Some integrated solutions offer client management features, helping professionals maintain essential client information and track billing histories.

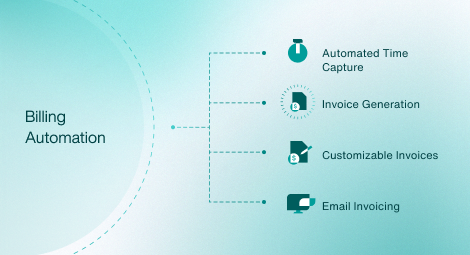

Automating the Billing Process for Accuracy and Faster Payments

Time and billing software automates various aspects of the billing process, enhancing efficiency and accuracy:

Automated Time Capture: Time tracking data is automatically transferred to the billing module, eliminating manual data entry and potential errors.

Invoice Generation: The software generates invoices based on recorded billable hours and rates, reducing the time spent on creating invoices manually.

Customizable Invoices: Professionals can customize invoice templates to include relevant details and branding elements, ensuring a professional and consistent appearance.

Email Invoicing: Some software solutions offer the option to email invoices directly to clients, expediting the billing process and promoting faster payments.

By utilizing time and billing software tailored for accountants and law firms, professionals can optimize their billing processes, minimize administrative burdens, and accelerate payment cycles.

The Significance of Legal Accounting Software for Law Firms

Efficient legal accounting is vital for the success of law firms. As legal practices manage various financial aspects, from client billing to internal financial reporting, having robust legal accounting software becomes essential.

In this section, we will highlight the significance of legal accounting software for law firms. We will explore how this specialized software streamlines financial processes, enhances compliance with accounting regulations, and enables law firms to maintain accurate and transparent financial records.

Streamlining Financial Processes and Maintaining Compliance

Legal accounting software plays a pivotal role in streamlining financial processes within law firms:

Invoicing and Billing: The software automates the invoicing and billing process, generating accurate and professional invoices for clients based on billable hours and agreed-upon rates.

Expense Tracking: Legal accounting software allows law firms to track various expenses, including operational costs and reimbursable expenses, ensuring comprehensive financial oversight.

Trust Accounting: Specialized legal accounting solutions often include trust accounting features, enabling proper handling and tracking of client trust funds.

Time and Billing Integration: Integration with time tracking and billing software ensures that time entries are seamlessly incorporated into client invoices, minimizing billing errors.

Strategies for Tracking and Optimizing Billable Hours

Tracking and optimizing billable hours are crucial for law firms to maximize their revenue and profitability. Efficient time tracking practices not only ensure accurate client billing but also provide valuable insights into resource allocation and productivity.

In this section, we will explore effective strategies for tracking and optimizing billable hours. We will discuss how law firms can leverage technology and best practices to streamline time tracking, improve billable hours management, and boost overall revenue.

Utilizing Software to Improve Billable Hours Management

Law firm billing software and time tracking tools play a pivotal role in improving billable hours management:

Automated Time Tracking: Time tracking software automates the recording of billable hours, reducing the risk of underreporting and ensuring accuracy in time entries.

Real-Time Tracking: With real-time tracking capabilities, legal professionals can capture billable activities as they occur, minimizing time leakage and increasing billable hours.

Task-Based Time Entries: Often allows time entries to be linked to specific tasks, providing insights into the time spent on various legal activities.

Mobile Accessibility: Mobile time tracking apps enable attorneys to log billable hours on-the-go, ensuring that no billable activities are missed.

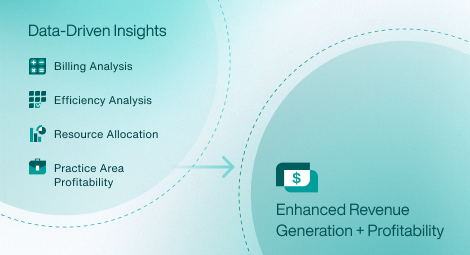

Enhancing Revenue Generation and Profitability Through Data-Driven Insights

By utilizing technology for billable hours management, law firms can gain valuable data-driven insights to enhance revenue generation and profitability:

Resource Allocation: Data on billable hours and task performance help law firms optimize resource allocation, ensuring that the right professionals handle appropriate tasks.

Efficiency Analysis: Time tracking data enables law firms to identify inefficiencies, allowing them to implement process improvements and enhance productivity.

Billing Analysis: Detailed time entries facilitate accurate and transparent billing, fostering positive client relationships and trust.

Practice Area Profitability: Data on billable hours per practice area provides insights into the profitability of different legal services, guiding strategic decision-making.

By adopting effective strategies and leveraging software for billable hours management, law firms can maximize their revenue potential, achieve better profitability, and ultimately deliver exceptional value to their clients.

Utilizing Legal Invoice Templates for Clear and Professional Invoicing

Clear and professional invoicing is vital for law firms to maintain transparency and credibility with their clients. Legal invoice templates offer a standardized format that ensures consistency and professionalism in billing.

In this section, we will explore the benefits of using legal invoice templates for invoicing clients. We will discuss how these templates streamline the invoicing process, improve client understanding of billing details, and enhance overall invoicing efficiency.

Customizing Templates to Meet Specific Client Needs and Requirements

While legal invoice templates provide a standardized format, they are also highly customizable to meet the unique needs and requirements of each client. Key aspects of customization include:

Personalized Branding: Law firms can add their logo, contact information, and branding elements to the template for a professional and cohesive look.

Itemized Billing: Legal invoice templates allow for itemized billing, providing a breakdown of services rendered and associated costs for complete transparency.

Terms and Payment Instructions: Customizable sections enable law firms to include specific terms, payment instructions, and due dates, ensuring clarity for clients.

Client-Specific Details: Templates can be adapted to include client-specific details, such as matter numbers or reference codes, for easier identification and record-keeping.

Streamlining the Invoicing Process for Prompt and Accurate Payments

Legal invoice templates streamline the invoicing process, resulting in prompt and accurate payments:

Efficiency: By utilizing templates, law firms save time in generating invoices, allowing them to focus on other essential tasks.

Consistency: Standardized templates promote consistency in invoicing, reducing errors and potential discrepancies.

Timely Invoicing: Templates facilitate the timely generation of invoices, ensuring clients receive bills promptly.

Improved Cash Flow: Clear and professional invoices lead to quicker payment processing, positively impacting law firms' cash flow.

By leveraging legal invoice templates and customizing them to fit individual client needs, law firms can optimize their invoicing process, foster positive client relationships, and maintain financial transparency.

Factors to Consider When Selecting Legal Billing Software

Selecting the right billing software is a critical decision that can significantly impact a firm's efficiency and financial management. To make an informed choice, law firms should consider various factors:

User-Friendly Interface: An intuitive and user-friendly interface ensures that legal professionals can easily navigate and utilize the software without extensive training.

Comprehensive Features: Law firm billing software should offer a comprehensive set of features, including time tracking, invoicing, expense management, reporting, and integration capabilities.

Cloud-Based Solution: Cloud-based software provides accessibility from anywhere with an internet connection, facilitating remote work and collaboration.

Security Measures: Robust security measures, such as data encryption and multi-factor authentication, are essential to protect sensitive client and financial information.

Evaluating Software Features, Integrations, and Scalability

In this section, we will explore the importance of evaluating software features, integrations, and scalability:

Features: A thorough evaluation of features ensures that the software meets the specific needs and workflows of the law firm. This includes assessing the software's ability to handle trust accounting, recurring billing, and customizable invoice templates.

Integrations: Seamless integration with other tools and software used by the law firm enhances efficiency and prevents data silos. Integration with case management and accounting software, for instance, streamlines data sharing and eliminates duplicate data entry.

Scalability: As law firms grow, their billing needs may change. Choosing scalable law firm billing software allows the firm to adapt the software to accommodate increased caseloads and expanded operations.

Addressing Common Questions and Concerns in the Selection Process

During the selection process, law firms often have questions and concerns regarding the suitability of the software for their practice:

Ease of Implementation: Firms may wonder about the implementation process and how quickly they can start using the software effectively.

Training and Support: Adequate training and ongoing support are vital to ensure that all team members can use the software efficiently.

Cost and ROI: Law firms must consider the software's cost and weigh it against the expected return on investment in terms of time savings, improved billing accuracy, and streamlined financial management.

By carefully considering these key factors and addressing common questions and concerns, law firms can make an informed decision and select legal billing software that aligns with their specific needs and contributes to their overall success.

Encouraging Legal Professionals to Leverage Technology for Success

Incorporating law firm billing software into daily operations is a strategic move for legal professionals looking to stay competitive and succeed in a fast-paced legal landscape:

Adaptability: Embracing technology demonstrates a law firm's adaptability and readiness to embrace innovative solutions for improved client service.

Competitive Edge: Firms that leverage law firm billing software gain a competitive edge by delivering streamlined and efficient billing experiences to their clients.

Client-Centric Approach: Efficient billing processes enhance client satisfaction, as clients appreciate accurate and timely invoicing.

Growth and Expansion: Law firms planning for growth and expansion can benefit from law firm billing software that scales with their evolving needs.

By embracing efficiency with legal billing software, legal professionals can optimize their workflows, enhance client experiences, and position their firm for sustained success.