The management of client payments is a critical aspect of a law firm's financial health. Small or large, all law firms grapple with client payment challenges at some point. In this blog post, we'll analyze the greatest client payment challenges in law firms, and explore how to overcome them.

Legal billing and payment processes are the lifeblood of your practice, and inefficient practices can have repercussions on the financial stability of law firms, irrespective of their size. The challenges are varied, from cash flow management to accommodating diverse payment options, ensuring compliance, and accurately tracking billable hours. But rest assured, for every challenge, there exists a solution.

Throughout this article, we'll explore these challenges and provide practical solutions to empower small and large law firms to navigate the complexities of billing and payment processes efficiently. Whether you're a small firm aiming for growth or a large firm looking to streamline your financial operations, this article is your guide to conquering the challenges and optimizing your legal billing systems.

Common Billing Issues for Small and Large Firms

We have talked about the importance of streamlining payments for clients but never about the intricate landscape of law firms billing issues. Billing issues come in various forms and can affect practices of all sizes. Whether you're running a small firm to expand or managing a large firm dealing with high caseloads, these common billing challenges can impact your financial health and client relations. Let's explore these issues in detail:

1. Cash Flow Crunch:

Law firms, regardless of their size, often grapple with irregular cash flow patterns. Delayed payments or inconsistent invoicing can lead to financial stress. Small firms, in particular, may feel the pinch when clients extend payment timelines, affecting their ability to meet financial obligations. For large firms, cash flow management can become more intricate as the scale and complexity of billing increase.

2. Diverse Payment Options:

Clients have diverse preferences for payment methods. Large firms may face difficulties accommodating various payment options for clients, while smaller firms may find the integration of such options challenging. Failure to provide flexibility in payment choices can lead to dissatisfaction and payment delays.

Learn more about what payment options you can provide at your law firm from our previous blog post.

Learn more about what payment options you can provide at your law firm from our previous blog post.

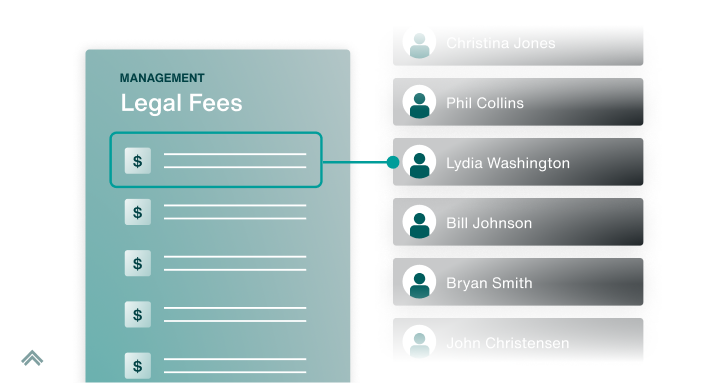

3. Legal Fee Management:

Managing legal fees efficiently is crucial for law firms. This includes accurate tracking of billable hours, setting appropriate legal fees, and ensuring transparent communication with clients. Small firms often face the challenge of establishing competitive fee structures, while large firms must maintain consistency and accuracy in their billing practices.

4. Compliance Complexity:

Legal billing involves intricate compliance requirements. Small firms might struggle with understanding and implementing these legal billing standards, while large firms must manage the complexities of compliance across multiple cases, clients, and locations. Compliance errors can lead to penalties and damage a law firm's reputation.

5. Billable Hours Tracking:

Keeping an accurate record of billable hours is essential for both small and large firms. The challenge is to establish systems and processes that ensure that no billable hours are missed or inaccurately reported. For small firms, this can be an issue of capacity and organization, while for large firms, it involves managing a high volume of data accurately.

Solving the common billing issues for firms requires understanding these issues and acknowledging that they can be tackled effectively with the right strategies and tools. The subsequent sections of this blog will delve into solutions and best practices to address these challenges and enhance the billing and payment experience for clients and law firms alike.

The Significance of Billing for Small and Large Firms

Billing is the lifeblood of law firms. It serves as the financial pulse that keeps the organization running smoothly ensures profitability, and enhances client relationships. The importance of efficient billing processes extends to law firms of all sizes. Let's explore why billing is a critical aspect of legal practice:

1. Financial Health:

Effective billing is the cornerstone of financial health for law firms. It's not just about collecting fees; it's about managing the firm's income, expenses, and overall cash flow. Smooth billing processes enable firms to meet financial obligations, invest in growth, and remain financially stable.

2. Cash Flow Management:

Billing directly affects cash flow. Inconsistent or delayed billing can lead to cash flow crunches, which can disrupt day-to-day operations. In contrast, streamlined billing processes ensure a steady and predictable cash flow, empowering law firms to operate efficiently.

3. Profitability:

Profitability is a critical measure of a law firm's success. Effective billing maximizes revenue while minimizing costs. Both small and large firms need to ensure that their billing practices are not only accurate but also efficient to maintain profitability.

4. Client Satisfaction:

Billing has a direct impact on client satisfaction. A smooth and transparent billing process enhances the client experience. Clients appreciate clarity in invoicing, the ability to make payments easily, and understanding the legal fees they are being charged. Dissatisfaction with billing practices can strain client relationships, potentially leading to disputes or even loss of clients.

5. Legal Fee Transparency:

Transparency in legal fee billing is crucial for both small and large firms. It builds trust with clients, reduces disputes, and sets a positive tone for the client-lawyer relationship. Clear and transparent billing demonstrates professionalism and accountability.

Faster Capital explains the importance of legal fee transparency. "Legal fee transparency not only helps build trust between attorneys and clients but also ensures that clients can make informed decisions about their legal matters."

6. Compliance and Reputation:

Billing processes must comply with legal and ethical standards. For large firms, maintaining compliance across various cases, practice areas, and locations can be a significant challenge. Regulatory violations can tarnish a firm's reputation and lead to penalties, affecting its overall success.

Billing practices impact the firm's financial health, cash flow, profitability, and client relationships. The following sections will explore solutions and strategies to overcome billing challenges and ensure a seamless billing process for both small and large firms.

Solutions for Legal Billing Issues

In the dynamic landscape of law firms, billing issues are a common challenge. However, there are numerous solutions available to address these concerns effectively. Whether you're running a small firm or managing a large one, these solutions can make a substantial difference in streamlining your billing processes:

1. Law Firm Billing Software:

Utilizing dedicated law firm billing software can revolutionize your billing practices. These solutions are designed to meet the unique needs of legal practices. They streamline the entire billing process, from capturing billable hours to generating invoices. Law firm billing software not only enhances efficiency but also helps ensure accuracy in billing. These systems often offer features like automated billing, invoice tracking, and reporting to simplify the billing workflow.

2. Invoice Management Systems:

Invoice management systems are integral to effective billing. These platforms allow law firms to create, manage, and monitor invoices with ease. They often include features like customization, so you can tailor invoices to your clients' specific requirements. Additionally, these systems facilitate invoice tracking, providing transparency to both the firm and the client. This transparency can lead to fewer billing disputes and enhanced client trust.

3. Fee Lending Solutions:

Fee lending solutions are particularly beneficial for small firms that may experience cash flow challenges due to delayed payments. These solutions offer advances on your legal fees, providing much-needed financial flexibility. This allows you to cover expenses and invest in your practice while awaiting client payments.

Ivan Vislavskiy from Comradweb explains it well when it comes to embracing alternative fee arrangements, "Embracing alternative fee arrangements is a strategic way to improve law firm profitability. Instead of relying solely on traditional hourly billing, law firms can offer alternative fee structures that align with client preferences and the value delivered"

4. Legal Fee Lending:

For larger firms, legal fee lending can serve as a valuable financial tool. It provides the firm with the ability to access funds quickly, even before clients settle their bills. This helps maintain financial stability, especially when dealing with ongoing cases with significant legal fees.

By implementing law firm billing software, invoice management systems, and considering fee lending or legal fee lending options, you can effectively overcome billing challenges, improve cash flow, enhance client relationships, and ensure financial stability. The following sections will delve deeper into how these solutions work and how to integrate them into your firm's operations.

Overcoming Billing Challenges

Billing challenges in law firms can be complex, but with the right strategies, they can be overcome effectively. Here are some practical tips and solutions for tackling common billing issues:

1. Prioritize Compliance:

Ensuring billing compliance is critical. Legal billing often comes with stringent regulations and ethical considerations. Staying compliant not only helps maintain your firm's reputation but also minimizes the risk of disputes or legal issues. Invest in training and tools that help your team understand and adhere to billing regulations.

2. Enhance Billable Hours Tracking:

Accurate tracking of billable hours is essential for proper billing. Consider using software tools designed for time tracking. These tools can automatically capture billable hours as you work on cases, making the process more efficient and accurate. Regularly review billable hours charts to identify trends and make necessary adjustments.

3. Streamline Payment Options:

Providing multiple payment options can make it more convenient for clients to settle their bills. Accepting credit card payments or electronic fund transfers can expedite payments. You might also explore online payment platforms that integrate with your billing software for seamless transactions.

4. Invest in Training and Education:

Your legal billing admin team is at the forefront of managing billing issues. Providing training and resources to enhance their skills in billing processes can be a game-changer. Continual education ensures that they remain up-to-date with best practices and billing regulations.

5. Regular Billing Audits:

Conduct regular billing audits to identify errors, inaccuracies, or discrepancies. Audits can help you spot issues early and take corrective measures. This proactive approach ensures that your billing processes remain accurate and reliable.

6. Clear Communication:

Open and clear communication with clients is essential. Providing clients with detailed invoices, explanations of charges, and responding promptly to their queries can foster trust and improve client satisfaction. This, in turn, can lead to more efficient payments.

In overcoming billing challenges, it's essential to maintain a strong focus on compliance, tracking, and transparency in your billing processes. Implementing these strategies will not only help your firm enhance its billing efficiency but also contribute to maintaining a positive client-law firm relationship.

Mastering Legal Billing: A Path to Law Firm Success

In conclusion, addressing billing challenges in law firms is not just about streamlining processes; it's about ensuring the financial health and sustainability of your practice. Whether you're running a small law firm or a large one, efficient billing practices are essential.

To recap, here are the key takeaways from this article:

Common Billing Issues: Small and large law firms face common billing challenges related to cash flow, payment options, legal fees, compliance, and billable hours.

Billing's Significance: Efficient billing processes are crucial for maintaining your firm's financial health, profitability, and client satisfaction. They impact cash flow and overall business performance.

Solutions for Billing Issues: Solutions like law firm billing software, invoice management systems, fee lending options, and adherence to compliance standards can help address billing challenges.

In light of these takeaways, it's crucial for law firms to explore and implement suitable solutions that fit their unique needs. By adopting efficient billing practices, you not only ensure a steady cash flow but also build trust and satisfaction among your clients, which can lead to long-lasting client relationships and success in your legal practice.

For more in-depth insights and guidance on overcoming billing challenges, please refer to the preceding sections of this article.

Remember that efficient billing processes are an integral part of the legal profession. By addressing billing challenges head-on, you can ensure the continued success and growth of your law firm.