In the dynamic realm of legal practice, delivering exceptional service to clients requires not only high-quality counseling but also a convenient and efficient administrative process. As an attorney, legal billing administrator, or part of a law firm, you understand the critical role that payment options play in fostering client satisfaction and smooth business operations.

In this blog, we delve into the world of legal billing and payments, offering you insights into various payment options and their potential benefits. We'll explore the diverse needs of different practice areas, discuss the tools and software available to streamline legal payments, and even address some common challenges associated with financial transactions. Whether you specialize in family law, estates, criminal defense, or transactional/contract law, this blog aims to provide you with valuable information to appreciate your financial processes.

Suppose you're ready to discover the payment options that can take your legal practice to the next level. Read on. Your journey to efficient legal billing starts here.

Understanding Legal Billing and Payment Needs

Efficient billing and payment processes are the cornerstones of client satisfaction and law firm operations. As a legal professional,, comprehending these aspects is vital to ensuring smooth and reliable financial transactions.

Legal Billing Software: The Backbone of Financial Management

Legal billing software is more than just a tool; it's the backbone of financial management in the legal industry. This software streamlines the invoicing process, helping law firms stay organized and ensuring they receive payments promptly. Whether you're dealing with family law cases, estates, criminal defense matters, or contracts and transactional law, legal billing software can adapt to the unique needs of your practice area.

Diverse Payment Needs for Different Practice Areas

The needs of legal billing and payment options can vary significantly between different practice areas. For instance, in family law, clients might prefer the flexibility of recurring credit card payments to ensure a steady flow of funds for ongoing legal support. Conversely, in estates, upfront lump sum payments could be more common due to the nature of the cases.

Anticipating Potential Challenges

While offering various payment options is advantageous, it's crucial to be prepared for potential drawbacks. Clients may occasionally raise concerns, such as chargebacks where they mistakenly blame the law firm instead of the issuer, or credit limit issues that hinder their ability to process payments. Addressing these challenges effectively is essential for maintaining strong client relationships and ensuring the flow of funds.

In the following sections, we'll explore specific payment options and the tools and strategies available to streamline legal billing. So, if you're ready to enhance your billing processes for a seamless client experience, read on.

Types of Payment Options for Law Firms

In today's digital age, offering various payment options is essential for law firms to meet the diverse financial needs of their clients. Below, we'll explore some of the primary payment methods and their advantages:

1. Credit Card Processing for Lawyers

Credit card payments are a popular and convenient choice for many clients. This option allows clients to pay using their credit cards, providing flexibility in managing payments. The benefits of credit card processing for lawyers include:

Convenience: Clients can make payments from anywhere, anytime, reducing the need for manual processing.

Swift Transactions: Credit card payments are usually processed quickly, ensuring prompt fund transfers.

Automated Tracking: Legal billing software can automatically track and record credit card payments, simplifying financial management.

2. Legal Payment Financing Options

In some cases, clients may require financial support to manage their legal fees.

Legal Payments

financing options are designed to address these situations. Here are the key features and benefits:

Flexible Terms: Legal payment financing allows clients to spread their payments over an extended period, making legal services more accessible.

No Credit Checks: These financing options often do not require stringent credit checks, making it easier for clients to qualify.

Improving Client Experience: By offering financing, law firms demonstrate a commitment to their clients' financial well-being, potentially improving overall client satisfaction.

Incorporating these payment options into your law firm's financial toolkit can significantly reinforce your clients' experience. The choice of payment method should be tailored to each client's unique financial situation and the nature of the legal services you provide.

Tools and Software for Legal Payments

In the realm of

legal Payments

, having the right tools and software at your disposal is indispensable. Here's a closer look at some essential technologies that can streamline your law firm's billing process and strengthen client satisfaction:

1. Attorney Billing Software:

Investing in specialized attorney billing software is a game-changer for law firms. This software automates various billing tasks, ensuring accuracy, efficiency, and compliance. Key features include:

Invoice Generation: Attorney billing software generates professional invoices, detailing services, costs, and payment terms, ensuring transparency for clients.

Time Tracking: It enables lawyers to track billable hours accurately, facilitating precise billing.

Expense Management: The software allows easy tracking and inclusion of expenses related to cases, enhancing overall transparency in billing.

Client Portals: Clients can access their invoices, payment history, and other legal documents securely through client portals, enhancing communication.

2. Email Invoicing and Online Payment Links:

Email invoicing is a practical method for delivering invoices to clients directly to their email inbox. Here's why it's effective:

Speed and Convenience: Email invoicing accelerates the invoicing process, reducing the time clients need to receive and process their bills.

Digital Record-Keeping: Clients can store digital copies of their invoices, simplifying record-keeping and eliminating the need for paper copies.

Online Payment Links: Including online payment links within emails simplifies the payment process. Clients can click the link and make secure payments directly, reducing friction in the transaction process. This approach is especially convenient for clients who prefer digital transactions.

3. Invoicing Software:

Invoicing software automates the creation and management of invoices. It ensures consistency in formatting, reduces human errors, and expedites the entire invoicing process. Invoicing software often integrates with payment gateways, enabling seamless and secure transactions.

By integrating these tools into your payment processes, you not only improve the efficiency of your billing operations but also provide clients with convenient and secure payment options. In the next section, we'll explore the potential challenges associated with legal payments and effective strategies to overcome them, ensuring a smooth financial experience for both your law firm and your clients.

Managing Financial Transactions

Managing financial transactions in a legal billing context involves various considerations and steps that are vital to ensure both efficiency and compliance. Let's delve into the specifics:

1. Connecting Bank Accounts:

One of the foundational steps in setting up a robust legal payment system is connecting your law firm's bank accounts. This connectivity enables the seamless transfer of funds between your clients and your firm. When connecting bank accounts, it's essential to ensure the highest levels of security to safeguard sensitive financial data.

2. 3rd Party Integrations:

Offering 3rd part integrations such as Apple Pay, Google Pay, Zelle and more, as a payment option adds to the convenience of your clients. It allows them to use their digital accounts for secure transactions. Integrating digital providers with your legal payment system can also expedite payments, contributing to a better client experience.

3. Retrieving Credit Card Information:

Your legal payment system may include the capability to retrieve credit card information for returning clients. This feature enhances convenience, as clients don't have to re-enter their card details for each transaction. However, it's crucial to prioritize the security of stored credit card information, complying with data protection regulations like the Payment Card Industry Data Security Standard (PCI DSS).

Security, Compliance, and Financial Management:

Ensuring the security of financial transactions is paramount, not only to protect your clients' sensitive data but also to maintain the reputation and trust of your law firm. Compliance with data protection laws, industry regulations, and payment processing standards is essential. Legal billing and payment systems should adhere to these compliance requirements.

Effective financial management is equally critical. It involves tracking financial data accurately, managing cash flow efficiently, and providing transparent and error-free financial documentation. Your clients must have confidence in your financial practices and transparency in billing, which can positively impact their overall satisfaction.

In the next section, we'll explore some advanced features that can further strenghten the payment options your law firm provides, ultimately contributing to client satisfaction and loyalty.

Common Challenges and How to Overcome Them

While offering diverse payment options in your law firm is crucial for enhancing client satisfaction, it's essential to be aware of and address common challenges that may arise during financial transactions. Here, we'll discuss some of these challenges and provide guidance on how to overcome them:

1. Chargebacks:

Chargebacks can be a concern in the legal payment process. Clients may dispute a transaction with their credit card issuer, and the amount can be charged back to your law firm. This can lead to disputes and potential financial losses.

How to Overcome Chargebacks:

Clear Communication: Ensure clear and transparent communication with your clients. Address any concerns or discrepancies promptly to prevent chargeback requests.

Document All Transactions: Keep comprehensive records of all transactions, including invoices, receipts, and client communications. This documentation can be invaluable when disputing chargebacks.

Payment Policies: Establish and communicate clear payment policies to clients. Let them know what to expect regarding payment methods, schedules, and dispute resolution procedures.

2. Credit Limit Issues:

Some clients may encounter problems processing payments due to low credit limits on their credit cards. This can lead to payment delays and challenges in receiving funds.

How to Avoid Credit Limit Issues:

Diversify Payment Options: Offer multiple payment options, including credit card payments, ACH/bank transfers, and legal financing options. This enables clients to choose the method that best suits their financial situation.

Offer Payment Plans: Provide flexible payment plans or legal financing options for clients who may have credit limit constraints.

Communicate: Maintain open lines of communication with clients to address any issues or limitations they may face with their chosen payment method.

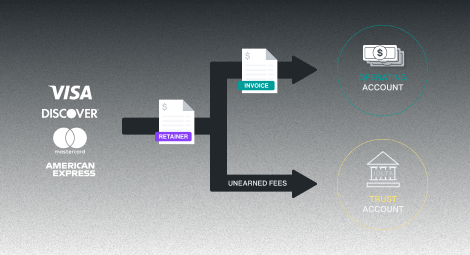

3. IOLTA Account Payments:

Some law firms handle IOLTA (Interest on Lawyers' Trust Accounts) for client funds. Processing payments related to IOLTA accounts requires specific attention to compliance and security.

Handling IOLTA Account Payments:

Compliance: Ensure strict compliance with the rules and regulations governing IOLTA accounts, which vary by jurisdiction.

Dedicated Accounting: Maintain separate and dedicated accounting and record-keeping for IOLTA funds to prevent commingling.

Automated Tools: Implement automated tools within your legal payment system to manage IOLTA transactions securely.

By addressing these challenges proactively and providing clients with options that suit their needs and financial situations, you can maintain smooth and efficient financial transactions, ultimately enhancing client satisfaction and trust in your law firm. In the following section, we'll explore additional considerations for providing diverse payment options and how they contribute to a better client experience.

The Power of Diverse Payment Options in the Legal World

In closing, it's clear that offering diverse payment options is an essential aspect of client satisfaction in the legal profession. Understanding the unique payment needs of different practice areas and leveraging modern attorney billing software can streamline financial transactions. By overcoming common payment challenges, law firms can enhance client trust and ensure that payments are efficient, secure, and tailored to individual needs.

As you consider the payment options for your law firm, remember that flexibility and convenience are key. Embracing a range of secure and efficient payment methods sets you apart as a client-focused legal practice, ensuring that every financial transaction is as smooth and satisfying as the legal services you provide.

Give Filevines

Time and Billing Demo a Spin. - Click

Here to Receive a Free Demo